Saving $100K on your next home sounds crazy, right? Savings like this can be life-changing and could allow you to do so much more with your future plans. Believe it or not, with knowledge and a few changes, this could be your reality.

A Strategy…

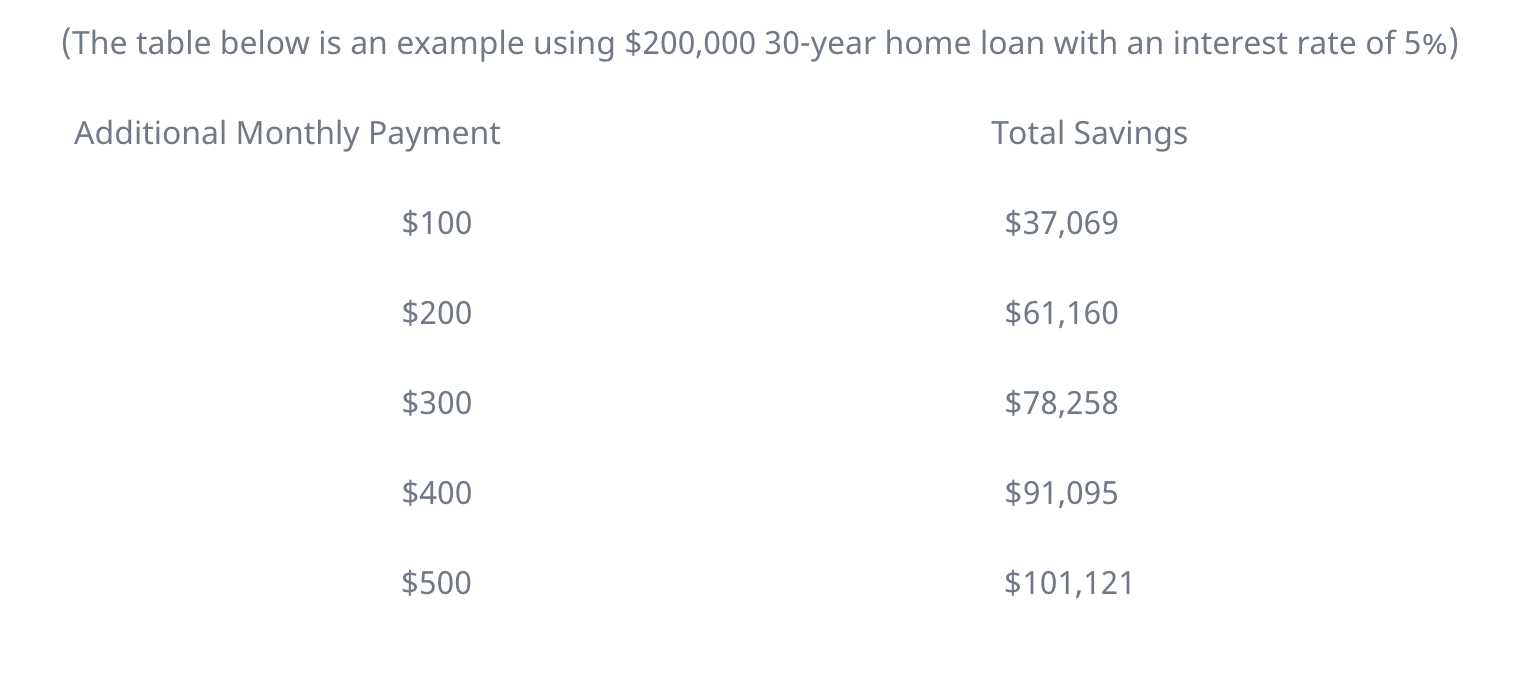

that will save you thousands of dollars in interest charges is paying extra on your mortgage monthly. This can eliminate multiple years off of your home loan.

Understand that paying down the principal quicker on your home does not decrease your minimum payment each month. However, it will shorten the life of the loan and save you more money than most can save on their own.

Here are three ways to save you thousands on your next home!

1. Increase Your Monthly Checks by One-Twelfth

Some people do not know this, but the largest part of your early year payments go toward paying interest. If you pay a little extra on your principal now, this will make a significant amount of savings down the road.

The additional 1/12th of your monthly payment will decrease the balance on your current principal and likely avoid some of those interest charges.

2. Make One Extra Payment Per Year

If you get an annual bonus or a nice size tax return check, use it to pay one extra mortgage payment each year. You will cut the life of the loan significantly and save thousands in interest.

3. Pay Half of Your Monthly Payment Bi-Weekly

This takes a little more effort, but you could authorize an automatic transfer from your checking account to savings account bi-weekly. You will have made 26 half payments, which will become 13 full payments at the end of the year without even realizing it!

4. Look How Much You Can Save

Calculate how much you can save on your own mortgage using our mortgage payoff calculator.

Contact us today to talk about getting pre-qualified.