- (858) 526-3037

- Carl.Spiteri@Benchmark.us

- Mon - Fri: 9:00 - 6:30

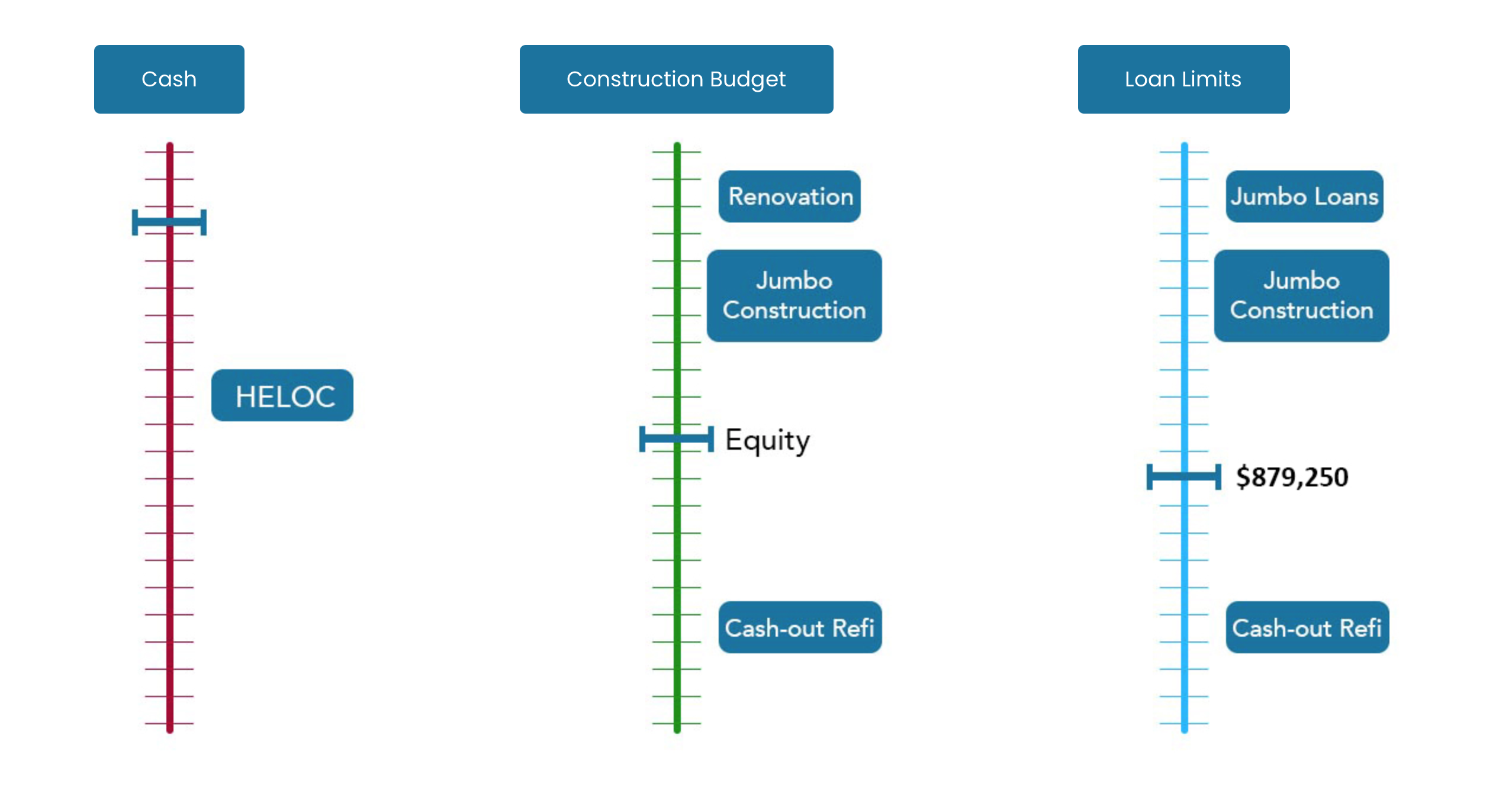

Most homeowners qualify to finance an ADU several financing options are available. One popular option is refinancing your current loan and pulling out equity to finance your ADU. ADU budgets can start out at $80,000 but most will range in $200,000 to $300,000.

Not all homeowners will have sufficient equity for an ADU, then you can consider renovation loans from HUD & Fannie Mae. The key advantage is these loans are based on the future value of the property. Anytime a renovation adds square footage, it’s highly valued and appraised.

Other loans are also available that can be considered: constructions loans, jumbo loans & hard money loans.

Utilize up to 80% equity of your home to fund the ADU. This offers a lower interest rate and terms available in construction

Term | Interest | Owner Occupancy | Fund Control | Renovation Budget Limit |

Fixed/Variable | Lower | Yes | No | Equity |

Term | Interest | Owner Occupancy | Fund Control | Renovation Budget Limit |

Adj | Var | Yes | No | Equity |

Gov’t backed financing that will base construction funds based on the future value of the property.

Low-down payment | Mort. Ins. | Appraisal | Owner Occupancy | Renovation Budget Limit | |

FHA – 203k | 3.5% | Yes | 110% | Req | Future Value |

Fannie Mae – Homestyle | 5.0% | No > 20% equity | 95% | No | Future Value |

Interest Term | Interest | Owner Occupancy | Fund Control | Renovation Budget Limit |

Fixed/Var | Custom | 2nds only | Yes | Future Value |

Term | Interest | Owner Occupancy | Fund Control | Renovation Budget Limit |

Fixed/Var | Custom | No | Yes | Future Value |

Term | Interest | Owner Occupancy | Fund Control | Renovation Budget Limit |

Fixed | Higher | No | Yes | Future Value |

Term | Interest | Owner Occupancy | Fund Control | Renovation Budget Limit |

Fixed/Variable | Custom | Yes | No | Equity |

Create financing to meet the unique needs of the client and project.

Create and finance affordable housing for a loved one. It's taking care of family. See how financing creates unmatched affordable housing.

Learn from the experts, build equity and income with an ADU to offset mortgage payments, build your investment strategy and more.

Leverage your real estate asset to create monthly income with an ADU. Passive income is vital to your retirement strategy. Let our experts with government HECM loans (Reverse mtg) to finance your ADU.

Schedule a Free Consultation

We have a team of professionals to assist every step of the way. From a free initial consultation to financing, planning to construction, we have a coordinated process from an experienced team with you every step of the way. Meet our experts to fully understand your needs. We’ll explore the best financing that meets your financial goals. Our Feasibility will evaluate your site, develop plans, determine budget and timeline to completion. Our expertise and teamwork will come in on time and on budget.

11622 El Camino Real, Suite 100 San Diego, CA 92130

Carl Spiteri | NMLS ID 286890

Phone: 619.544.6444

Office: 858.526.3037

eFax: 800.670.0929

Ark-La-Tex Financial Services, LLC NMLS ID 2143

Carl Spiteri | NMLS ID 286890

Ark-La-Tex Financial Services, LLC d/b/a Benchmark Mortgage 5160 Tennyson Pkwy STE 1000, Plano, TX 75024. NMLS ID #2143 (www.nmlsconsumeraccess.org) 972-398-7676. Some products may not be available in all licensed locations. Information, rates, and pricing are subject to change without prior notice at the sole discretion of Ark-La-Tex Financial Services, LLC. All loan programs subject to borrowers meeting appropriate underwriting conditions. This is not a commitment to lend. Other restrictions may apply. (https://benchmark.us)